The credit trading revolution is finally here. Catch this webinar replay to discover the alpha opportunities for systematic investors.

The credit trading revolution is finally here. Catch this webinar replay to discover the alpha opportunities for systematic investors.

October 9 2023

Heralding the return of fixed income

Investors have heralded the return of bonds over the past two years, as interest rates and yields jumped to levels that were last seen more than a decade ago. The surge in inflation has forced central banks to embark on the fastest and steepest hiking cycle since the 1970s, directly impacting interest rates and bond yields.

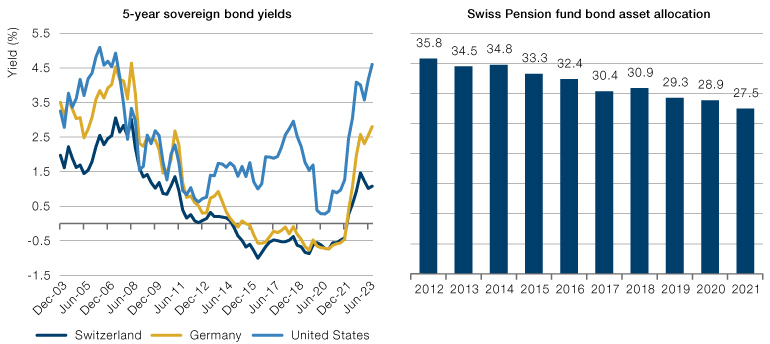

The asset class had lost much of its allure during the years of low and negative interest rates as yields tumbled, diversification wavered, and coupons vanished. In Switzerland, institutional investors, such as pension funds have shunned bonds with allocations plunging to record lows. We revisit the role of bonds in that they provide multiple advantages for institutional investors (income, liability matching, diversification, and excess returns) and how private investors can benefit in the current market context.

The fall in global yields has led Swiss pension funds to reduce their allocation over the past years

The technicalities: for institutional investors

Most institutional investors (banks, pension funds, insurance…) have certain cash outflows that can be predicted or are recurring. As a result, the “low risk” of bonds measured by historical volatility, the seniority of cash flows and the ability to match duration with liabilities means that bonds are a critical asset for institutional portfolios. However, in the case of Swiss pension funds, the prolonged fall in interest rates has resulted in an increase in the value of liabilities and the need to find alternative assets that could offer higher expected returns (equities and real estate). With the current rise in interest rates, it is likely that bond allocation will recover from the recent lows.

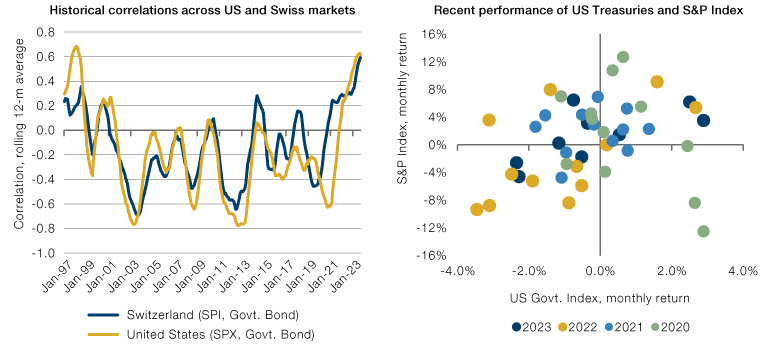

Diversification: a myth of the past?

Historically, bonds offer diversification from equities, especially during times of market turbulence. As the notion of “flight to safety” translates into negative equity returns and positive bond returns. More recently, this has not been the case, with plenty of debate about bonds failing to deliver in times of stress and equities out-performing as yields decline.

Diversification, not so helpful recently

Looking at the correlation between bonds and equities in the US and in Switzerland, we find similar pattern of low correlations over time offering diversification for an equity-bond portfolio. Since Covid-19, correlations have jumped to levels seen in the 1990s. Between 2022 and 2023, US bond-equity correlations have increased meaningfully offering little benefit from diversification. While it is not uncommon to see bonds-equities move in tandem, historically adding bonds to an equity portfolio should provide for diversification.

Income: The return of the coupon

Coupons are a critical feature for investors when investing in bonds, as these not only help to meet recurring cash outlays, but also help to smoothen market volatility by providing a recurring stream of income. However, the low period of interest rates has resulted in meagre coupon returns, for example the monthly income in the Swiss investment grade market was close to 0.20% per month and dropped to 0.05% by 2021. Thankfully, as interest rates sustain at higher levels, coupons will return to become a significant driver of returns in a bond portfolio.

Active credit opportunities:

Another role that bonds play within an institutional portfolio is also to generate excess returns by taking credit risk. Unlike the stable stream of coupons, this is a more volatile component as it reflects the market’s perception of credit risk across issuers and varies with the economic cycle. Currently, the credit spread across developed markets for investment grade credit is above historical averages spanning back to the early 2000s. This credit spread component can offer significant dispersion across sectors and ratings offering investors additional source of return. An active credit selection approach requires significant expertise in taking advantage of credit dispersion opportunities.

How can private investors benefit from bonds?

Indeed, bonds play a crucial role for institutional investors, not only to help match their liabilities, but also to provide diversification, a steady stream of income and excess returns. Similarly, private investors can also benefit from allocating to bonds by taking advantage of the higher yields, coupons and credit opportunities that can ultimately provide for a diversified source of return compared to equities and with historically a lower level of risk. In fact, investment grade bonds (rating between AAA and BBB-) currently offer levels of interest rate and credit spreads that are historically attractive. At the same time, the current opportunity favors an active investment management style to fully take advantage of the return of the asset class.

You are now exiting our website

Please be aware that you are now exiting the Asteria Investment Managers website. Links to our social media pages are provided only as a reference and courtesy to our users. Asteria Investment Managers has no control over such pages, does not recommend or endorse any opinions or non-Asteria Investment Managers related information or content of such sites and makes no warranties as to their content. Asteria Investment Managers assumes no liability for non Asteria Investment Managers related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Asteria Investment Managers.