Fixed income investors had a mixed year in 2023. Despite expectations of a strong start due to a softening outlook, the global economy performed well amidst rising interest rates.

Fixed income investors had a mixed year in 2023. Despite expectations of a strong start due to a softening outlook, the global economy performed well amidst rising interest rates.

January 29 2024

Green Bonds in 2023: Key Highlights

Fixed income investors had a mixed year in 2023. Despite expectations of a strong start due to a softening outlook, the global economy performed well amidst rising interest rates. By the end of the summer, US and European investment grade bonds were underperforming risk markets, delivering low-single digit returns. The prospects for the year deteriorated further in October, as US interest rates jumped past 5% on the back of a resilient economy. Finally, the tables turned, as evidence of slowing inflation prompted markets to price interest rate cuts as soon as the first quarter of 2024. Bonds roared back in the fourth quarter delivering one of the best quarters on record. We look at a few key highlights that shaped the green bond market in 2023.

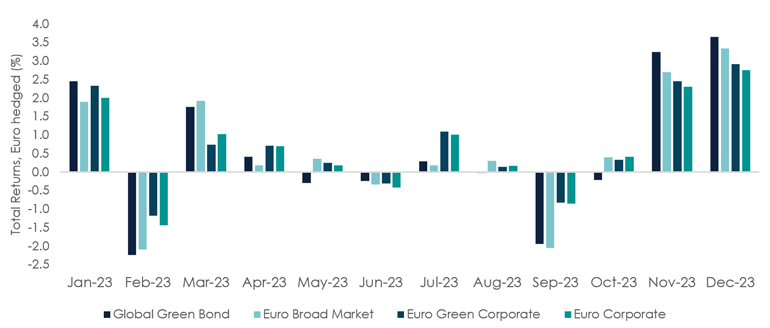

Performance: Out-performing conventional indices

Green bond indices out-performed their conventional counterparts as the combination of duration and credit spreads supported both total and excess returns throughout the year and benefitting from a larger exposure to corporate bonds.

Green Bond indices delivered strong absolute and relative returns

Source: Asteria Investment Managers, ICE Index

The Green Bond index out-performed in January, November and December on the back of tightening credit spreads and duration. On the other hand, it under-performed in May, August and October as US interest rates jumped and curves bear steepened. On a name basis, focussing on Euro corporate bonds, relative out-performers include utilities such as TenneT Holding, Engie, Iberdrola and real estate names such as CTP NV and Gecina SA.

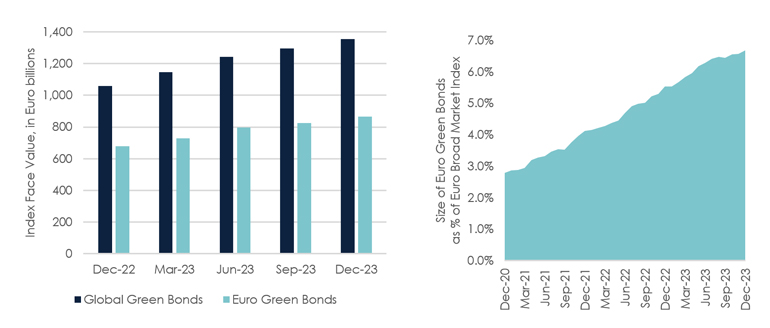

Growth: Continuing to take market share, albeit at a slower pace

The Global Green Bond index continued to grow and stop shy of Euro1.4trillion, a 30% increase compared to December 2022 and significantly higher than the1% net growth of the ICE global IG index. On the other hand, the growth rate has declined likely on the back of volatile market conditions and strong issuance during the past few years.

Green Bonds continue to grow in size and gain market share in Europe

Source: Asteria Investment Managers, ICE Index

Euro-denominated bonds contributed most in terms of growth and now account for 6.7% of the Euro Broad market index, gaining further market share. Interestingly, CHF, NZD and GBP denominated green bonds grew more than 50%, while USD growth trailed at 24% to reach $280bn in face value. USD issuance was largely driven by “yankee” bonds with issuers domiciled in the UAE, Saudi Arabia and Hong Kong. Finally, the market welcomed several new issuers such as Israel, India, Siemens Energy, DS Smith and Eastman Chemical.

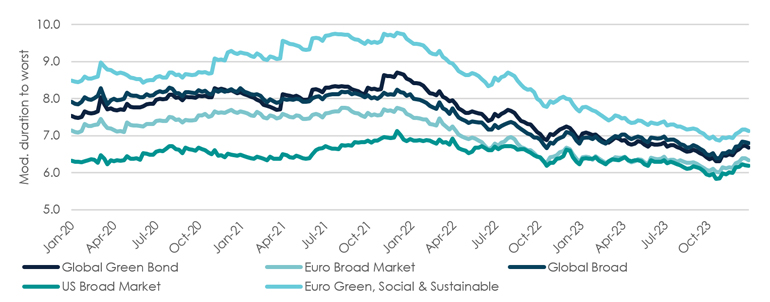

Duration: from risk to opportunity?

In 2023 we discussed about the “duration gap” between green bonds and traditional benchmarks (Mind the (duration) gap: from risk to opportunity in green bonds | Asteria Investment Managers (asteria-im.com)) which was a source of risk and underperformance compared to traditional indices. The “gap” has steadily declined over the past quarters as net issuance and market effects help to reduce interest rate sensitivity. This in turn can present an opportunity for investors who are seeking higher interest rate sensitivity while gaining exposure to green projects.

Green Bond index duration has fallen closer in-line with traditional benchmarks

Source: Asteria Investment Managers, ICE Index

The chart shows how sustainable bond indices carry a higher interest rate sensitivity compared to broad-aggregate indices. As of December 2023, the Global Green Bond index duration was 6.7 marginally higher than that of the Euro Broad index of 6.4, but significantly less than in 2021 when the difference was close to 1.0 (or 12% higher). The largest decline in duration is that of the Euro Green, Social & Sustainable index which saw duration peak close to 10 in 2021 and has fallen closer in line with other indices.

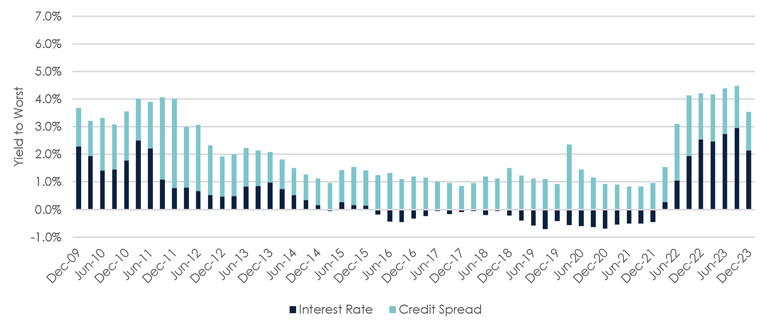

Valuations: Benefitting from investment grade valuations

The rise in interest rates and credit spreads has been broad-based, lifting yields across investment grade markets, including green bonds.

Euro corporate investment grade valuations are most compelling since 2010

Source: ICE Euro Corporate Index (ER00), Asteria Investment Managers, ICE Index

Despite the significant rally in the fourth quarter, all-in-yields offer investors an attractive combination of high interest rates (government yield) and credit spreads. This is especially true in Europe, where corporate bond yields rank in the top 20th percentile since 2010.

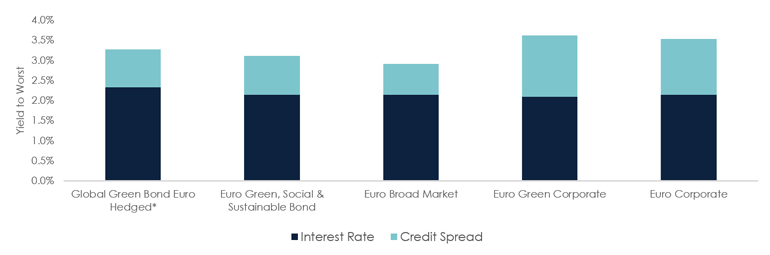

Green Bond index valuation compares favourably to European IG benchmarks

*Interest Rate component reduced by USD hedging costs

Source: Asteria Investment Managers, ICE Index, December 2023

From a cross-market perspective, the green bond index screens favourably compared to Euro bond indices (Euro-denominated bonds account more than 60% of the index), even when adjusting for USD carry. This is thanks to a larger share of Euro corporate bonds in the index (30%) which contribute to the higher credit spread component. Similarly, the Euro Green Corporate index has a higher credit spread thanks to its larger share of Utilities, Real Estate and Banks, as well as BBB-rated bonds.

Outlook: Valuation tailwinds, climbing maturity walls and new standards

As with global investment grade markets, green bonds are well positioned to benefit from valuation tailwinds given the mix of high interest rates and credit spreads. This is especially true as speculation increases around interest rate cuts and a soft-landing. In addition, the mix of Euro Corporate exposure in the index should continue to benefit relative performance. On the other hand, the index will face a larger maturity wall (over next 18months) as legacy USD green bonds are up for refinancing, this could turn to be a source of risk for USD green bond growth. On the regulatory and reporting front, the EU Green Bond Standard, a voluntary framework, will come into effect towards the end of the year and we expect to see European issuers such as utilities and sovereign-related entities attempt to align and revisit their issuance frameworks to meet these new standards and further increase transparency. Overall, the outlook remains positive for green bond investors as the combination of valuations, performance and transparency are tailwinds that can help allocate more capital towards green climate financing solutions.

You are now exiting our website

Please be aware that you are now exiting the Asteria Investment Managers website. Links to our social media pages are provided only as a reference and courtesy to our users. Asteria Investment Managers has no control over such pages, does not recommend or endorse any opinions or non-Asteria Investment Managers related information or content of such sites and makes no warranties as to their content. Asteria Investment Managers assumes no liability for non Asteria Investment Managers related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Asteria Investment Managers.