Fixed income investors have a significant role to play in financing the climate transition.

Fixed income investors have a significant role to play in financing the climate transition.

March 25 2024

Hybrid Utility Green Bonds and Financing the Climate Transition

Fixed income investors have a significant role to play in financing the climate transition. Bloomberg NEF estimates investment needs ranging between $2 and $6.7 trillion per year; half will be allocated towards “energy supply” such as renewable energy, grid infrastructure and fossil fuel related energy processes1. As a result, utility companies are central in any climate transition scenario and will require significant financing and capital. In turn, debt capital markets will continue to be the main source of funding whether through asset-based, bank lending or bond issuance. Hybrid green bonds are an additional tool to finance the growing investment needs of the climate transition.

The Euro-denominated utility hybrid green bond market sits at the intersection between hybrid bonds and green bonds. While this market is a fraction of fixed income markets, it can offer benefits to issuers and investors, albeit with its own set of risks.

Hybrid Bonds: A Bond (usually), but not always

Hybrid bonds (also known as perpetual bonds) are a subordinated financial instrument that combine bond and equity features. The bond-like features include an initial fixed coupon for a pre-determined amount of time i.e. a fixed coupon bond. Thereafter the instrument transforms into a floating rate with a long tenor maturity, hence the term “perpetual”. Typically, the issuer calls the bond at its first call-date. However, it retains the option not to do so and this is a significant risk for investors. This “extension risk” negatively impacts the present value of cash flows as the tenor lengthens close to “perpetuity”.

The equity-like features relate to the ability of the issuer to (at any time and at its discretion) defer coupon payments, write-down of the principal and/or convert the principal to common equity or into another hybrid instrument. These equity-features have the purpose to act like capital buffers to absorb losses and/or conserve cash and defer repayment.

Due to these hybrid characteristics (and risks), investors will demand a higher yield compared to senior bonds, but lower than the cost of equity. As a result, the instruments will also be more volatile as they sit between senior bonds and equity.

Finally, issuers in heavy capex industries, stable cash flows and dividend driven payouts will typically be the main issuers of these instruments as it optimizes the cost of financing and avoids issuing equity.

A credit rating agency perspective: Equity content, early redemptions and more

The role of credit rating agencies is important in the decision process of issuing a hybrid bond as the equity-features and the intent of the issuer will determine if the hybrid benefits from a “high” (100% equity), “intermediate” (50% equity) or no equity content. The interest expense and principal is adjusted in credit ratios as dividend and equity, respectively. This allows issuers to avoid issuing equity while maintaining credit ratios within the appropriate levels. In the case of Standard & Poor’s (S&P) only an amount equal to 15% of capitalization can benefit from any equity content, the excess is treated as debt.

A further consideration for issuers is that early redemptions, repurchases and replacement of hybrid instruments reduce the amount of capital available to absorb losses or preserve cash which negatively impacts the equity content. For example, in the case of S&P only 10% over any 12-month period and up to 25% over 10-years can be retired without losing equity content2.

Overall, hybrid bonds should be a long-term layer in the capital structure to absorb losses and preserve cash, rather than an alternative (and cheaper) to issue equity.

Extension and coupon deferral risk

An example of extension-risk that investors faced is when AroundTown, a European real estate investment trust, announced in November 2022 that it would not exercise its call option for its 3.75% hybrid note with first call date in January 2023. This was driven by an economic decision where issuing a new hybrid bond would be more expensive than the increase of floating rate coupons. In addition, the company also commented that it would consider to defer coupon payments3. Similarly, the company has decided in December 2023 to not call its 4.542% hybrid with first call date in January 2024.

Markets had already anticipated this risk since 2022, however the price decline across its hybrid capital structure accelerated since the first announcement.

In the case of the 4.542% hybrid bond the next call date is in January 2025 with a yield of 156% which implies a remote likelihood of being called. The extension risk is reflected in the fact that the yield to maturity (January 2173) is 9.9%, significantly lower than the closest call dates4.

Green Hybrid Utility Bonds: A market overview

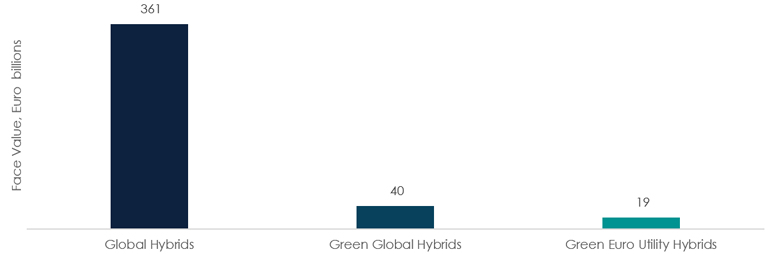

Based on internal estimates, the global hybrid market stands at Euro 360billion. Insurance, energy and telecom are the main issuers globally, while utilities account for the largest issuers of green hybrid bonds. We estimate that green hybrids amount to Euro 40bn of which 19bn issued by utilities in Euros.

Euro Hybrid Utility Bonds: A niche green market

Source: January 2024, Asteria Investment Managers, ICE Index, Bloomberg.

Global Hybrids are defined as subordinated and junior subordinated bonds excluding contingent capital and additional tier capital from financials. The universe is further screened based on data available on Bloomberg.

The fast-rising interest rate cycle and volatile credit spreads has constrained issuance in 2022 and 2023. Events such as the Credit Suisse debacle around its subordinated capital instruments and extension risk in real estate hybrids have also contributed to hinder issuance and demand for the instruments.

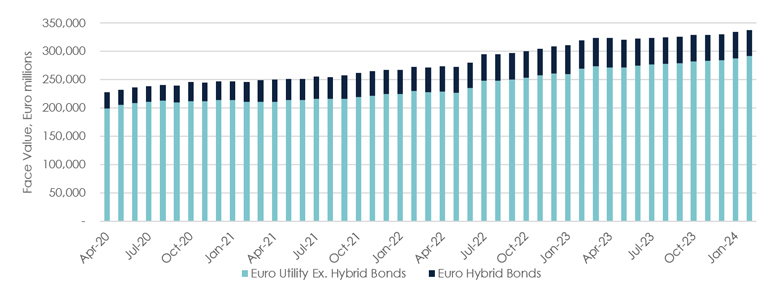

Utility Hybrids: Steady, despite the recent market challenges in 2022 and 2023

Source: January 2024, Asteria Investment Managers, ICE Index, Bloomberg

The face value of Euro hybrid bonds has jumped since 2020 from 29bn to 45bn by the end of 2023, a 54% increase; outpacing the 47% increase of non-hybrid bonds (senior and secured). However, the pace of growth slowed in 2022 and turned negative in 2023, while senior-secured issuance continued.

Most utility companies have issued at least one hybrid bond over the past years, with a growing portion in green format.

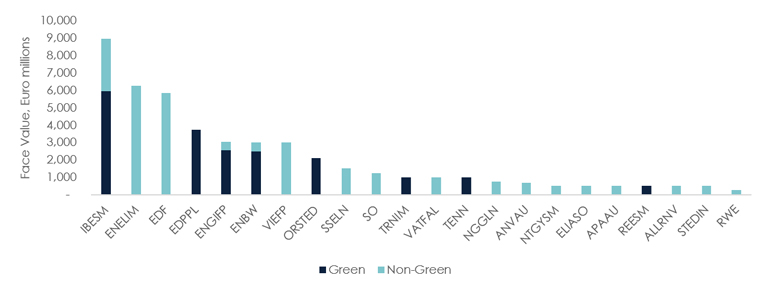

Hybrid Issuers: Concentrated among the larger utility companies

Source: January 2024, Asteria Investment Managers, ICE Index

Iberdrola (IBESM) has a total of Euro 6bn of green hybrids compared to an enterprise value of about Euro 145bn5. Similarly, Energias de Portugal (EDPPL) counts 5 green hybrids, followed by Engie (ENGIFP) and Energie Baden-Wuerttemberg (ENBW) with 60% of face value in green format. Orsted has a smaller nominal outstanding but 100% green, followed by issuers that have only one green hybrid outstanding.

Outliers are Enel (ENELIM) and Electricité de France (EDF) which are among the largest utilities in terms of total assets and active in the green bond market (senior bonds) but have not issued any green hybrids.

Financing the Climate Transition in Utilities

Green hybrid bonds combine hybrid features with those of green bonds where the proceeds are allocated and earmarked to (re)finance environmentally sustainable expenditures and projects.

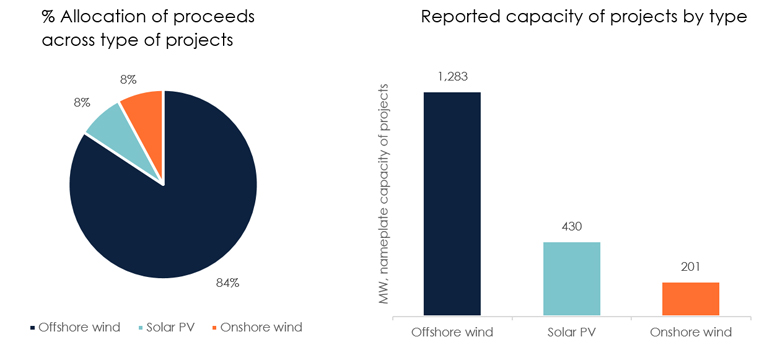

Case Study: Green hybrids financing renewable energy projects

An illustrative example of combining green format with a hybrid bond is that of Orsted. Based on the company’s green bond impact report of 2022, the use of proceeds of its green bonds have been allocated towards multiple solar and wind projects across the US, Taiwan, Germany and the UK.

In the case of the hybrid bond issued in 2021, the proceeds have been allocated to three offshore wind, one solar photo-voltaic and one on-shore wind project across the US, Germany and Taiwan6.

Financing green assets: Combining hybrid bond with renewable energy projects

Source: Asteria Investment Managers, Orsted AS – “Orsted green bond impact report 2022”

Most importantly, all of these projects were under-construction at the time underscoring how green hybrids are a tool to finance the climate transition.

Case Study: Hybrid capacity and capital expenditures

Most issuers have taken advantage of low interest rates during COVID-19 to add to their green hybrid debt stack to finance their growing green capital expenditures. However, their overall hybrid capacity has been conservative as issuers need to balance between credit rating limitations and higher cost of financing.

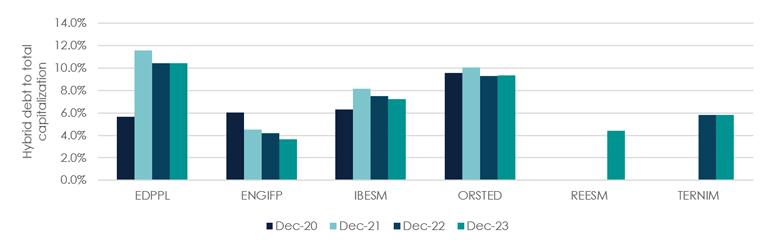

Hybrid Capacity: Issuers have increased or maintained their hybrid debt stack

Source: December 2023, Asteria Investment Managers, ICE Index, S&P Capital IQ

Energias de Portugal (EDPPL) has doubled its issuance of green hybrids since 2020. This comes on the back of the company’s increasing green capital expenditures for the coming years.

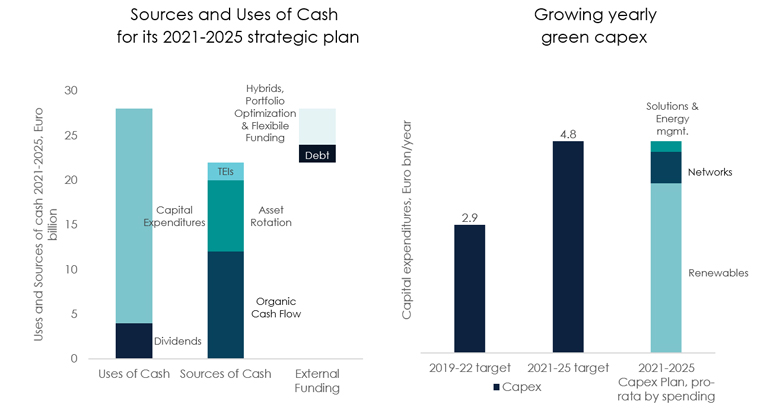

EDPPL’s 2021-2025 strategic plan: Hybrids play a role to finance its growing capex

Source: Asteria Investment Managers, EDP “Credit Investors Presentation” November 2021

EDPPL in 2021 guided for a strategic plan of Euro 24billion over a period of 5 years, implying an increase in capital expenditure from 2.9bn to 4.8bn a year, a 66% increase. Renewable capital expenditures would account for 80%, followed by networks and solutions-energy management7. To fund this growing capex, the company has guided that it would need to access external funding including the use of hybrid bonds (under the category Portfolio Optimization & Flexible Funding).

Another example is Redeia (REESM) and its subsidiary Redeia Electrica, Spanish transmission system operator launched its first green hybrid in 2023 to help finance its green capex needs. The rationale for the issuance of the hybrid instrument is to “reinforce the solidity of its capital structure”8 as the company increased its capital expenditure needs from Euro 3.35bn to 3.9bn, a 16% increase since 20219. As per S&P credit rating assessment, the agency expects that hybrid instruments will “remain a key, long-term instrument to protect its balance sheet amid increasing investments related to the Spanish energy transition”10.

Valuations: Hybrid risks, higher yields

Hybrid bonds offer higher yields given the instrument’s specific risks. To quantify this extra risk, investors can compare the yield of individual hybrid bonds with that of the same issuers’ unsecured bond. This will allow to measure the additional compensation to take hybrid bond risk for a specific issuer.

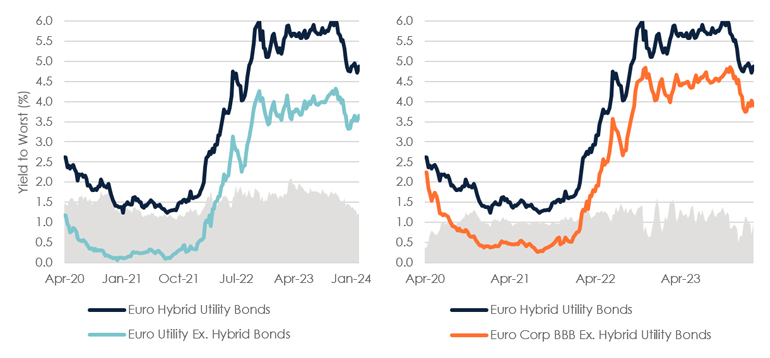

We generalize this approach by comparing a basket of Euro hybrid utility bonds with that of senior unsecured-secured utility bonds to quantify the compensation to move from senior bonds to hybrid instruments within the same sector. In addition, as hybrid bonds rating are in the BBB cohort, we also compare the basket to BBB corporate bonds.

Yield to Worst: Higher yield to compensate for hybrid risks

Source: January 2024, Asteria Investment Managers, ICE Index

The yield-differential (grey area) shows that the compensation for hybrid risk can vary meaningfully depending on market conditions. The recent rally across fixed income markets has pushed this differential towards recent lows at 122 and 97bps, respectively for the two charts.

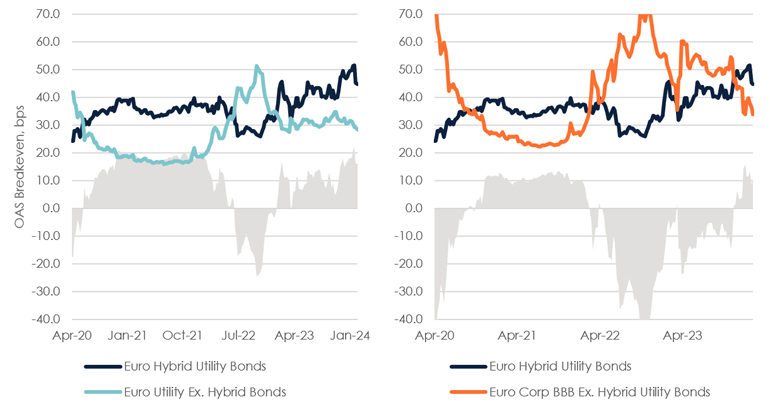

An additional metric useful in assessing the hybrid market is to look at the Option Adjusted Spread breakeven which represents how much credit spreads need to rise before credit return suffers losses; calculated as the spread over spread duration.

OAS Breakeven: Hybrids offer a higher buffer against credit spread sensitivity

Source: January 2024, Asteria Investment Managers, ICE Index

The current level to breakeven against higher credit spreads is 44bps compared to 29bps for senior utilities and 34bps for BBB bonds. This can be explained by the declining spread duration (lower denominator) as markets have normalized and the fear of extension risk has retraced. However, hybrids are sensitive to changes in credit spreads which explains the negative breakeven differential in 2022-2023.

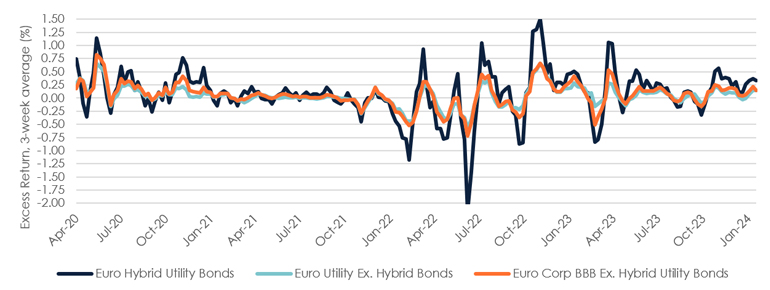

Portfolio Management: Higher returns, but with volatility

Given the valuation drivers explained above, hybrid bonds will exhibit higher returns, but also higher volatility. In fact, our analysis shows that utility hybrids will generate higher annualized excess returns of 5.4% compared to 2.2% for senior utility bonds and 3.2% for Euro corporate BBB bonds. However, the volatility of these returns is significantly higher at 6% compared to 2.2% and 2.8%, respectively.

Performance: Higher returns, but higher volatility

Source: January 2024, Asteria Investment Managers, ICE Index

The chart illustrates the rolling 3-week average excess returns, noticeably in periods of strong market performance such as in 2020, 2021 and the end of 2023 hybrid bonds have delivered higher excess returns. In contrast, when interest rate and credit spreads are volatile such as between 2022 and Q1 2023 hybrids under-perform significantly. As previously mentioned, the fears around extension-risk and coupon deferrals can significantly impact the price and returns of hybrid bonds to the downside.

Green Utility Hybrids: a permanent solution to finance the transition

Green hybrids will continue to be an important instrument for issuers to raise funding for their growing green capital expenditure needs. Given the characteristics of these instruments investors need to take an active approach in identifying the issuers and individual instruments that best fits within their investment objectives. Finally, combining hybrid characteristics with green bonds is an additional tool for issuers and investors to deploy capital in financing the climate transition.

1. Bloomberg NEF “New Energy Outlook 2022”

2. S&P “General Criteria: Hybrid Capital: Methodology and Assumption” November 2023

3. Aroundtown SA “Aroundtown SA decides not to exercise its option to voluntarily call EUR369million 3.75% Perpetuals Notes with call date in January 2023 issued by ATF Netherlands B.V.” November 2022

4. Bloomberg, March 2024

5. Bloomberg, December 2023

6. Orsted AS “Orsted green bond impact report 2022”

7. EDP “Credit Investors Presentation” November 2021

8. Redeia “Redeia issues green hybrid bonds to drive ecological transition in Spain”, January 2023

9. Redeia “Results FY 2023”, February 2024

10. S&P Global Ratings “Spanish Transmission System Operator Red Electrica’s Hybrid Instrument Rated BBB”, January 2023

You are now exiting our website

Please be aware that you are now exiting the Asteria Investment Managers website. Links to our social media pages are provided only as a reference and courtesy to our users. Asteria Investment Managers has no control over such pages, does not recommend or endorse any opinions or non-Asteria Investment Managers related information or content of such sites and makes no warranties as to their content. Asteria Investment Managers assumes no liability for non Asteria Investment Managers related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Asteria Investment Managers.